By Corporate Watch, with contributions from Shoal Collective

In Greece, as the economy returns to “business as usual” after the financial crash, the government is selling off massive new oil and gas fields in the Ionian sea and on the country’s western coast. But from Corfu in the north to Crete in the South, a resistance movement is growing to “save the Greek seas”. See our article here for an introduction to what’s happening.

One of the companies involved in the black gold rush is Energean: a fast-growing oil and gas company focused on the Eastern Mediterranean. It is currently active in Greece and Israel, but quickly expanding into new European and North African sites. Set up by Greek businessmen Mathios Rigas and Stathis Topouzoglu, until recently it was registered in Cyprus. But in 2018 Energean went global, becoming a UK-based Public Limited Company (PLC) listed on the London and Tel Aviv stock exchanges.

The company has grown dramatically in a few years, thanks to cash injections from a number of powerful global investors from the US, UK, Israel and Argentina. Twelve years ago it was a £1 million operation running one small oil field in north-eastern Greece. Now it is valued at nearly £1.8 billion, and is becoming a major player in the strategically important struggle for Mediterranean resources.

Key points

- Energean’s biggest shareholder is Third Point, a “vulture fund” owned by US billionaire Dan Loeb that profited massively from gambling on Greek bonds during the country’s debt crisis.

- Energean claims to have a “clean” record in terms of oil spills – but it has only run one small field itself, which has not had recent environmental assessments. Its drilling partners include companies responsible for some of the world’s most infamous oil disasters: for example, Halliburton, the Iraq War profiteer involved in Deepwater Horizon, the largest ever oil spill in North American waters.

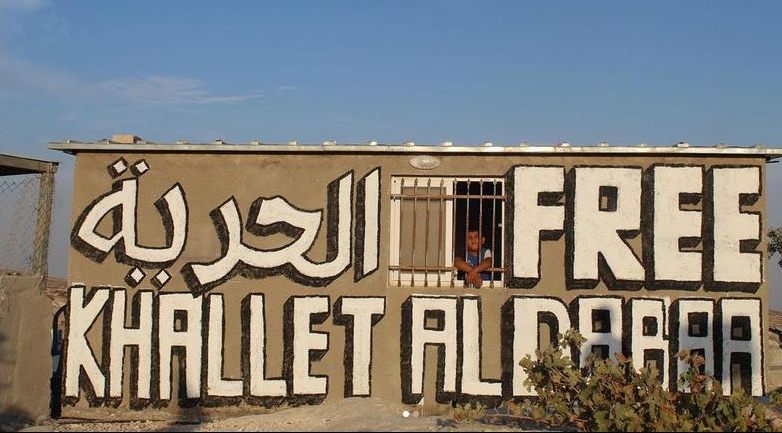

- Energean has close ties to the Israeli government and Israeli corporations. It is looking to acquire the disputed Gaza Marine gas field off the shore of the Gaza Strip. Its biggest lender is the Israel’s Bank HaPoalim, which finances illegal settlements. One of its main shareholders is IDB Development Group, a holding company that owns numerous businesses implicated in the occupied Palestinian territories.

- Energean has made a deal to sell all its current Greek oil production to one major partner: BP.

- Energean has recently signed a deal to buy the oil and gas assets of Italian company Edison, which include active wells in Egypt, Algeria, Italy and Croatia. This will nearly double its size. But Energean’s strong Israeli ties could provoke opposition in its new North African ventures.

Read the report on the Corporate Watch website

0 Comments